how to avoid tax on 457 withdrawal

Tax-deferred retirement accounts such as a 401k or traditional IRA are funded with pre-tax dollars. Take Charge Of Your Retirement Savings Today With These Quick And Personalized Tips.

Ad What Are Your Priorities.

. You can transfer or roll over assets tax-free from your 457 plan to a traditional IRA as often as you want after you leave your job. When you cash in your 457b you must pay ordinary income tax on anything you withdraw. Withdrawals from 457 retirement plans are taxed as ordinary income.

If you have a 457b you can withdraw the budget from your account without any early withdrawal penalty. However distributions from a ROTH 457 plan are not subject to tax withholding. If you meet the criteria for taking a distribution from your 457 plan you simply fill out a distribution request form from the financial institution that manages your 457 plan.

If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½ years old. Additionally the withdrawal can be used for non-arms length university expenses only if they are attending school half time. The ability to avoid the early withdrawal penalty if.

All of your contributions and earnings in a 457b plan are tax-deferred. In addition to any taxes you owe on your withdrawal you will owe an additional 10. 457 plans are non-qualified deferred-compensation plans offered to employees.

For this calculation we assume that all contributions to the retirement account. If you have a large 457b. Refine Your Retirement Strategy with Innovative Tools and Calculators.

Beneficiary distributions avoid the early withdrawal penalty of 10 percent. The amount you wish to withdraw from your qualified retirement plan. Ad What Are Your Priorities.

This penalty is on top of the income taxes that will due at your regular rate. The 457 is similar to the more widely known 401k plan where you can choose to contribute to the 457 plan through automatic deductions from your paycheck before the taxes. The amount you wish to withdraw from your qualified retirement plan.

Move on to Tax-Deferred Accounts. Governmental 457b distributions are not subject to the 10 additional tax except for distributions attributable to rollovers from another type of plan or IRA. Once you reach age 72 you have to.

However wit See more. If you miss the deadline the IRS will tax the. This means you wont pay any taxes.

With Merrill Explore 7 Priorities That May Matter Most To You. With Merrill Explore 7 Priorities That May Matter Most To You. However if you save on the 403b you will receive a 10 penalty on.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. In terms of health insurance an. You cant avoid paying income taxes by simply never taking distributions either.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Ad Youve Aced A Lot of Things In Life Now You Can Do the Same With Your Retirement. Like most retirement accounts the IRS imposes limits on how much can be contributed annually.

Withdrawals are subject to income tax. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The early withdrawal penalty is a 10 penalty.

Ad No Money To Pay IRS Back Tax. Contributions accumulate on a tax-deferred basis until distributed or for 457f plans when the employee is fully vested. For this calculation we assume that all contributions to the retirement account.

If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. Withdrawals are subject to income tax. Ad Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today.

How Can I Get My 401 K Money Without Paying Taxes

A Guide To 457 B Retirement Plans Smartasset

Tax Free Withdrawal Of Us Based Retirement Funds Sf Tax Counsel

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

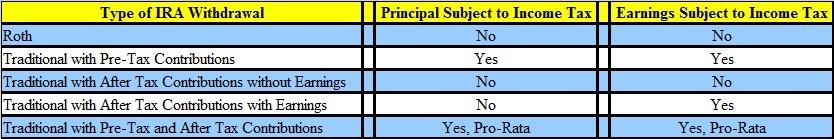

Iras Avoid Double Taxation On Withdrawals 08 01 16 Skloff Financial Group

Here S How To Avoid Costly Mistakes If You Inherit A 401 K Or Ira

How To Withdraw From Your Traditional 401 K Account Early And Avoid Penalties And Fees

Ira Early Withdrawal Penalties And Their Exceptions Toughnickel

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Ira Early Withdrawal Penalties And Their Exceptions Toughnickel

Iras Avoid Double Taxation On Withdrawals 08 01 16 Skloff Financial Group

What Happens If I Withdraw Money From My Tax Deferred Investments Before Age 59 Coastal Wealth Management

A Guide To 457 B Retirement Plans Smartasset

How Much Tax Do I Pay On 401k Withdrawal

How To Withdraw Money From Your 401 K Know Better Plan Better

How To Claim Hardship For Cashing Out My 401 K

Roth Ira Withdrawal Rules Estime De Soi Releve De Compte Assurance Vie